The last day of the week is bullish for the cryptocurrency market.

ADA/USD

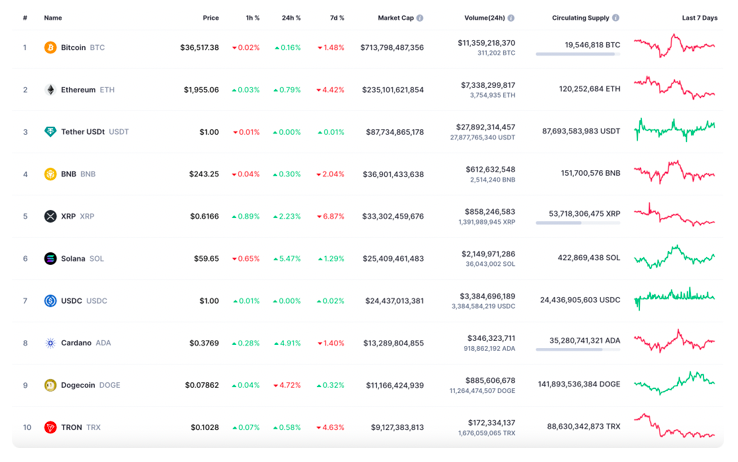

Cardano (ADA) has increased by almost 5% since yesterday, reaching a price of $1.25. However, the price has fallen by 1.40% over the last week.

On the hourly chart, the price of ADA is near the resistance level. However, it is unlikely that there will be any sharp moves today.

Most of the daily Average True Range (ATR) has been passed, which means that sideways trading in the area of $0.3750 is the more likely scenario.

The ATR is a measure of volatility, and it is calculated by taking the average of the high, low, and close prices for a given period of time. The daily ATR is calculated for a period of 24 hours.

When the ATR is high, it means that the price of the asset is volatile and is likely to experience sharp moves. When the ATR is low, it means that the price of the asset is not volatile and is likely to trade sideways.

In this case, the daily ATR has been passed, which means that the price of ADA is not volatile and is likely to trade sideways.

On the bigger time frame, the situation is quite similar. The price of ADA is near the resistance level. However, the price might need time to get more energy for a further move. In this case, consolidation in the range of $0.36-$0.38 is the more likely scenario for the next days.

Consolidation is a period of time when the price of an asset moves sideways. This can happen for a number of reasons, such as when the market is waiting for news or when there is a lack of liquidity.

In the case of ADA, the price has been consolidating in the range of $0.36-$0.38 for a few days. This suggests that the market is waiting for a catalyst to move the price in either direction.

If the price breaks above the resistance level at $0.38, it could target the next resistance level at $0.40. However, if the price breaks below the support level at $0.36, it could target the next support level at $0.34.

Overall, the outlook for ADA is neutral. The price is consolidating in a narrow range, and it is difficult to say which direction the price will break out in.

From a mid-term perspective, traders should focus on the closing price of the bar in relation to the resistance level of $0.3951. If the price closes near this level, it could lead to a breakout and an ongoing rise to the vital zone of $0.40 and above.

ADA is trading at $0.3747 at the time of writing.

A breakout is a technical term used to describe a situation when the price of an asset breaks through a resistance level. This can often lead to a further rise in the price of the asset.

The vital zone of $0.40 is a key resistance level for ADA. If the price breaks above this level, it could lead to a further rise in the price of the asset.

Overall, the outlook for ADA is positive. The price is consolidating in a narrow range, and it is possible that the price could break out to the upside.