In this article, we explore the “Telegram Open Network,” notable for its reliance on the cryptographic messaging app of the same name.

The inception of this network traces back to 2019, marked by an initial coin offering (ICO). However, subsequent events, including a legal dispute initiated by the U.S. Securities and Exchange Commission (SEC), hindered its progress.

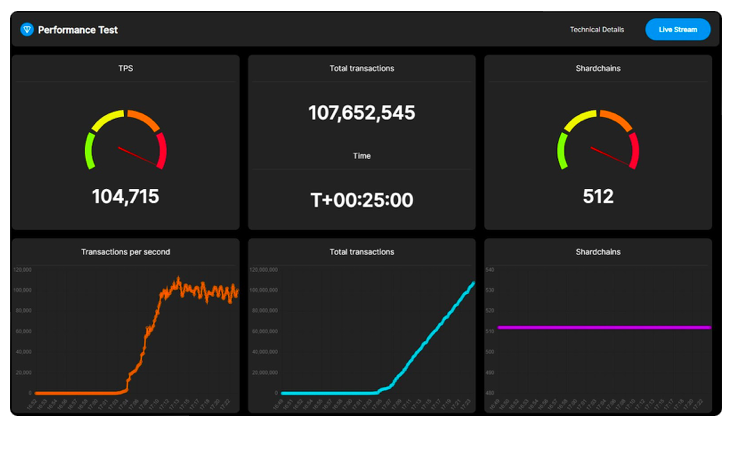

Presently, the Telegram Open Network holds the record for the world’s fastest blockchain, capable of processing over 104,000 transactions per second.

Within Telegram’s decentralized ecosystem, the cryptocurrency Toncoin (TON) has emerged, functioning as a governance, fuel, and stake token.

Over the past year, the price of TON has seen a notable increase, rising by 74%.

Detailed insights into the Telegram Open Network’s modular blockchain operation, the background of its creation, and its legal disputes with the SEC, as well as an overview of Toncoin (TON), are presented below.

Summary

- Understanding the Telegram Open Network and the functionality of its modular blockchain.

- Unraveling the origins of the Telegram Open Network and its legal conflicts with the SEC.

- Toncoin (TON): Exploring its role as the primary cryptocurrency asset within the Telegram ecosystem.

What is the functionality of the modular blockchain in the Telegram Open Network and how does it operate?

Telegram Open Network functions as a layer-1 modular blockchain built on a Proof-of-Stake consensus mechanism.

Diverging from monolithic networks like Ethereum, its unique technical structure comprises a masterchain along with various workchains and shardchains. This arrangement allows for “vertical” addition of blocks, resulting in exceptional infrastructure efficiency.

The architecture bears a resemblance to Polkadot, where the workchains in the Open Network are comparable to Gavin Wood’s network parachains, dependent on an underlying layer.

What sets this blockchain apart is its interoperability with Telegram, facilitating a potential user base of 700 million and streamlined cryptographic token exchanges. Integration with the messaging app enables activities such as installing a bot to manage transactions and engaging in coin exchanges through DEX and P2P modes.

This key aspect likely contributes significantly to the success of Open Network.

Another noteworthy feature is the “multi-blockchain” mechanism linking Telegram’s chain to other decentralized networks for specific tasks.

Presently, Open Network boasts a diverse ecosystem with numerous web3 applications in DeFi, NFT, DAO, wallet, infrastructure, and more.

The TON Foundation, overseeing network developments, aims to enhance user-friendliness and achieve widespread adoption.

As highlighted earlier, this blockchain holds a remarkable record as the world’s most scalable layer-1, with a calculated tp/s of 104,715, offering low fees and a minimal carbon footprint.

In performance tests conducted by auditing firm Certik, Open Network demonstrated its capability by accommodating 107,652,545 transactions in just 25 minutes.

The narrative surrounding the establishment of Telegram Open Network and its legal entanglements with the SEC.

The genesis of Telegram Open Network traces back to 2019 when Pavel and Nikolai Durov, founders of Telegram, introduced the initial prototype of the blockchain named “Gram.” They sought to launch the product into the market through an Initial Coin Offering (ICO).

Before the ICO sale concluded, the U.S. Securities and Exchange Commission (SEC) initiated an investigation into the project, alleging the sale of unregistered securities in the U.S. The SEC’s legal pursuit proved successful, as Gram’s investors were seen as anticipating profits from their investments.

The Durov brothers faced consequences, receiving an $18.5 million fine and being compelled to refund $1.2 billion from the ICO sale. Pavel Durov expressed his discontent in a blog post, lamenting the U.S.’s perceived unfair prevention of Gram’s distribution not only in their country but globally.

Despite this setback, the Telegram community rebounded a few years later. Since 2021, two projects have emerged within Telegram’s domain, orchestrated by the TON Foundation and a diverse group of developers.

The first project, initially named “TON” and later rebranded as “Open Network,” quickly gained traction through collaboration with Telegram. Anatoliy Makosov and Kirill Emelyanenko have led this project successfully.

The second project, initially titled “FreeTON” and later renamed “Everscale,” operates independently of Telegram and boasts a considerably smaller user base than the first.

Open Network aligned with Gram’s original vision of creating a globally accessible network using the messaging app as its interface. To circumvent past SEC challenges, the founders adopted a strategic approach. The distribution of the primary chain currency, crypto TON, occurred through mining, akin to the Proof-of-Work model. Once the predetermined TON supply was mined, the chain transitioned to the more functional and efficient Proof-of-Stake consensus mechanism.

This transition shielded against SEC scrutiny, as the distribution of TONs through mining was comparable to a “commodity,” similar to the mining processes of Bitcoin and Ethereum in the past. In June 2022, the entire supply of crypto TON was mined, prompting Open Network to shift to Proof-of-Stake.

Toncoin (TON): the primary cryptocurrency within the Telegram ecosystem.

Toncoin (TON) functions as the primary cryptocurrency within the Open Network ecosystem, serving as a governance, fuel, and staking token.

In practical terms, TON is utilized for voting on decentralized community decisions, covering gas fees on the Open Network, and engaging in distributed consensus through staking, specifically employing the Delegated Proof of Stake (DPOS) mechanism.

The designated staking platform is TON Nominator, requiring a minimum of 10,001 TON for access.

Additionally, there is an avenue for “mining” TON, despite the entire supply being in circulation. Users can utilize the “Ton Mining Pool” platform to mine BTC using software and convert the proceeds into TON.

Since its inception in September 2019, the price trajectory of the Telegram Open Network crypto has been notably volatile. Shortly after listing, it surged to surpass the $4.5 threshold, only to decrease to $0.8 a few months later.

However, from August 2023 onward, the coin has exhibited significant potential, achieving a remarkable +100% increase within just 50 days. This resurgence underscores the ecosystem’s inherent potential.

In conclusion, it is crucial to address a concerning issue for Toncoin (TON) and its blockchain.

Numerous members within the Telegram community have raised alarm about the lack of transparency during the years when the Proof-of-Work (POW) mechanism was active. The distribution of TONs through mining during this period appears to be non-transparent. Currently, concrete data regarding the actual total supply of the cryptocurrency remains elusive. Although both Coingecko and CoinMarketCap align on the figure of 5.05 billion units, there is still uncertainty.

On February 21, 2023, the community submitted a proposal urging the Foundation to provide clarity on this matter. The proposal highlights approximately 200 wallets that have remained inactive for several years, having mined a substantial amount of TONs during the early stages.

This lack of transparency shrouds TON’s past in mystery and raises a significant concern about the true value of the cryptocurrency. If it turns out that there is an additional supply beyond the expected, the cryptocurrency’s actual value might be lower than its current standing.