Bitcoin (BTC) kicked off November by surpassing the significant $70,000 mark, maintaining a steady hold above this level for several days. As the month begins, Finbold has analyzed Bitcoin’s historical performance to project its potential price for November 30.

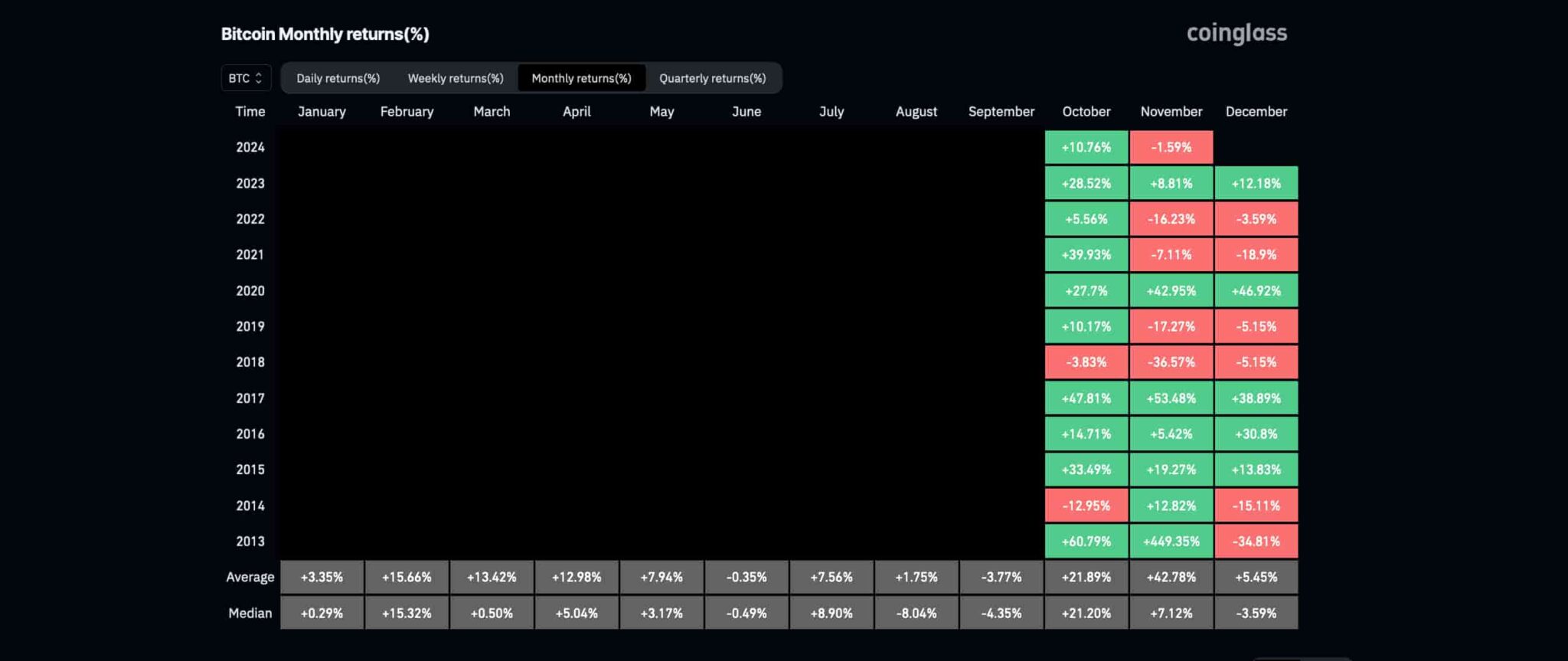

Looking back, Bitcoin wrapped up October with a 10.76% gain, capturing nearly half of the average and median returns typically seen during “Uptober.” According to Coinglass data, November historically posts even higher average returns than October, although its median returns are slightly lower.

Since 2013, Bitcoin has averaged a 42.78% gain in November, with positive returns in seven out of eleven years and a median gain of 7.12% from start to finish. November’s standout year was 2013, with a remarkable 449.35% gain, followed by 2017 and 2020, which saw gains of 53.48% and 42.95%, respectively. The lowest November performance occurred in 2018, with a steep -36.57% drop, closely followed by 2019.

Bitcoin (BTC) Price Prediction for November 30

Currently, Bitcoin is trading at $69,495, slightly below its November opening price of $70,272. The leading cryptocurrency has shown resilience, breaking out of both high and low time-frame downtrends and successfully retesting its lower time-frame support.

Based on historical returns, Bitcoin could range between $75,275 and $100,334 by the end of November, assuming it maintains its current momentum. This forecast leverages the median and average historical returns from November’s opening price to project BTC’s potential range for the month’s close.

While this analysis shouldn’t be considered in isolation, Bitcoin’s historical returns provide useful insights for traders and investors as the month’s price action unfolds.

Notably, Finbold shared two related analyses on Saturday, November 2, exploring the possibility of a $100,000 target for BTC. First, ChatGPT’s AI predicts that Bitcoin could reach this milestone by mid-to-late 2025. Meanwhile, analyst Alan Santana holds a similar view but cautions that the current rally might be a bull trap.

Ultimately, Bitcoin’s price is highly unpredictable due to the market’s volatility and inherent uncertainty. Investors are encouraged to understand the asset and consider various factors before making financial decisions.