As Bitcoin (BTC) experiences an unusually calm “Uptober,” a trading expert suggests that a review of technical indicators and past performance points to the potential for a new all-time high.

This forecast follows Bitcoin’s recent reclaim of the $62,000 level, with bulls eyeing the $65,000 resistance as the next hurdle.

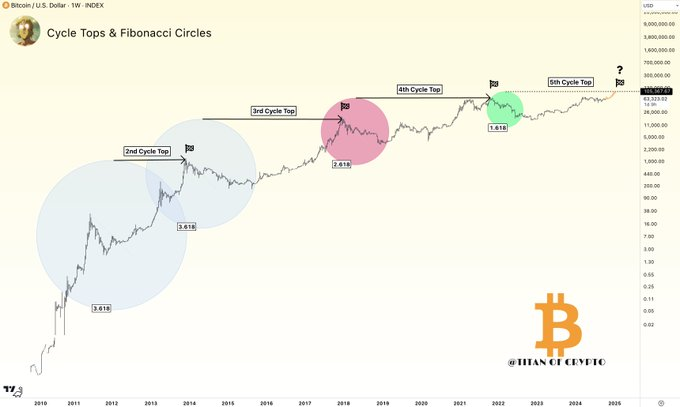

According to crypto analyst Titan of Crypto, Bitcoin could be on a path toward $105,000 in this cycle, based on Fibonacci circle analysis. In an X post on October 13, the analyst highlighted how historical cycle tops have aligned with key Fibonacci levels.

Bitcoin’s Technical Indicators

In 2013, Bitcoin’s second major cycle top hit the 3.618 Fibonacci level, setting a precedent for future movements. By 2017, the third cycle top aligned with the 2.618 Fibonacci level, showing strong gains but with diminishing returns. In 2021, Bitcoin’s fourth cycle peak reached the 1.618 level, continuing the trend of reduced returns with each cycle.

The current analysis suggests a potential top of around $105,000, again targeting the 1.618 Fibonacci level. While this is considered a conservative projection, the expert notes that Bitcoin could surpass this target in the current cycle.

Another analyst, Cryptocon, also analyzed Bitcoin cycles and highlighted a long-term bullish outlook based on the Consecutive Candles 9 (CC9) indicator. This technical signal suggests that Bitcoin could potentially reach a high of $240,000.

Bitcoin’s Bearish Outlook

This projection comes as Bitcoin recovers from its October 10 drop below $60,000 following the release of CPI data. Despite the rebound, analyst RLinda emphasized in an October 12 TradingView post that Bitcoin’s recent price action has reinforced a bearish market structure, marked by sharp fluctuations and an inability to sustain higher levels.

RLinda observed that after retesting the $59,000 level, Bitcoin surged by 7%, displaying heightened volatility without clear technical or fundamental support. Over the past two weeks, Bitcoin has seen rapid swings—dropping $6,000, rallying $4,000, falling another $5,000, and rising once more by $4,000. Despite these moves, Bitcoin remains stuck in a sideways trading range between $65,000 and $52,000.

According to RLinda, Bitcoin is currently testing a key resistance zone as part of its recent rally. However, without strong accumulation or technical signals, the price is likely to encounter resistance and struggle to break through.

Ali Martinez’s analysis indicates that the current fluctuations in Bitcoin’s price may be a positive sign. The volatility around the $60,000 level could pave the way for a potential rally toward $78,000.

Bitcoin Price Analysis

At press time, Bitcoin was trading at $62,770, down less than 1% over the last 24 hours. On a weekly basis, BTC has gained 1%.

In conclusion, as Bitcoin navigates a phase of volatility and consolidation within its sideways trading range, a cautiously optimistic outlook is warranted. To sustain upward momentum, Bitcoin must break through the key resistance level at $65,000.

While short-term fluctuations may persist, the possibility of reaching a new all-time high remains achievable if favorable market conditions emerge.