As of December 2023, INJ, the native token of Injective Protocol, has emerged as one of the highest-performing cryptocurrencies, outperforming both Bitcoin (BTC) and Ethereum (ETH).

Does on-chain data suggest that Injective Protocol is currently undervalued?

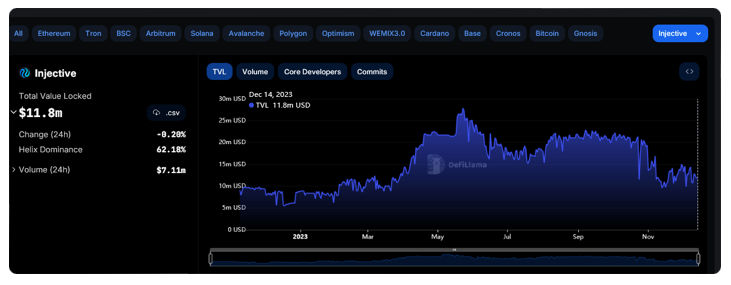

Speaking on December 14, Hartvigsen pointed out the platform’s comparatively modest total value locked (TVL) at $11 million and the restricted number of protocols currently available, which stands at seven.

As per the researcher’s examination, the primary decentralized application (dapp) on the layer-1, Helix Protocol, a decentralized exchange (DEX), currently registers a daily trading volume of approximately $7.4 million.

Hartvigsen points out that this figure is notably lower than that of other perpetual futures protocols, such as Perpetual Protocol. The analyst highlights that these competitors are currently valued at approximately $200 million and $300 million based on fully diluted valuation (FDV).

Examining the available data, there are currently only seven active protocols on Injective, with Helix overseeing more than 60% of the ecosystem’s total value locked (TVL), solidifying its dominant position.

Given the on-chain activity and the limited number of active protocols, Hartvigsen seeks compelling answers to unequivocally justify Injective Protocol’s valuation of $3.2 billion. The researcher draws comparisons with other blockchains, including Ethereum and Solana, which exhibit comparatively higher trading volumes and on-chain activity.

For instance, Hartvigsen references DefiLlama data indicating that Injective’s daily volume ranges between $5 million and $7 million across seven decentralized applications (dapps).

In contrast, Solana, a rival layer-1 platform, currently handles a daily volume ranging from $500 million to $700 million. Meanwhile, Injective Protocol falls short compared to Ethereum, which boasts a trading volume exceeding $1 billion.

With a 395% surge in INJ, the question arises: will the upward momentum persist due to investor optimism?

In response to Hartvigsen’s analysis, yiggit, a user identifying as a legal counsel, came to the defense of Injective Protocol. The user underscored that the Total Value Locked (TVL), highlighted by the researcher, should not be the exclusive factor in evaluating a project’s potential.

Yiggit emphasized that Injective Protocol’s promise lies in the anticipated number of upcoming applications. Notably, the legal counsel pointed out that optimism is also derived from Injective Protocol’s roots in the Cosmos ecosystem. In Cosmos, staking tends to stimulate participation as users seek to receive airdrops.

However, the validity of the researcher’s assessment remains contingent on time. Examining the daily chart of INJ’s price action thus far, the coin has been consistently ascending, marking new all-time highs.

For instance, since mid-October 2023, INJ has surged by 395%, aligning with the broader recovery in the cryptocurrency market. At this valuation, CoinMarketCap data indicates that the project boasts a market cap exceeding $2.7 billion.