The worldwide blockchain finance market, covering public and private blockchains, trading, payments, settlements, and asset management, is poised for substantial growth, expected to reach a valuation of $79.3 billion by 2032.

According to a report from Allied Market Research, participants in the blockchain finance sector are actively exploring collaborations and acquisitions as a primary strategy. The disruptions caused by the COVID-19 pandemic in traditional finance, combined with the potential for operational cost reduction, have paved the way for the widespread adoption of the digital ecosystem.

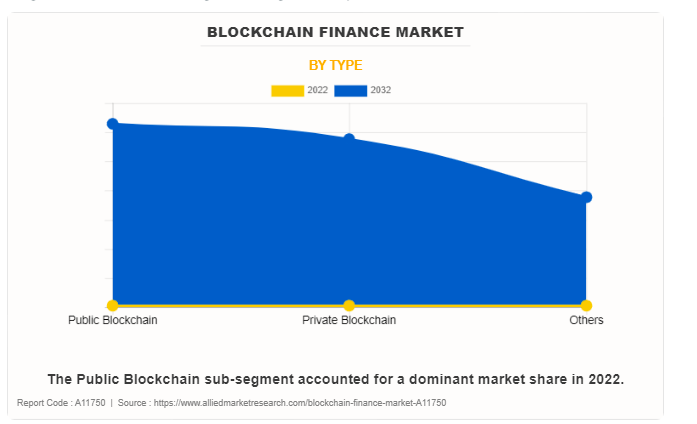

The public blockchain sub-sector holds the majority of the market share. This information is sourced from Allied Market Research.

As of 2023, the public blockchain sub-category dominates the landscape in terms of blockchain usage worldwide. Prominent cryptocurrency ecosystems such as Bitcoin (BTC) and Ether (ETH) rely on public blockchains. The report highlights several advantages associated with public blockchains:

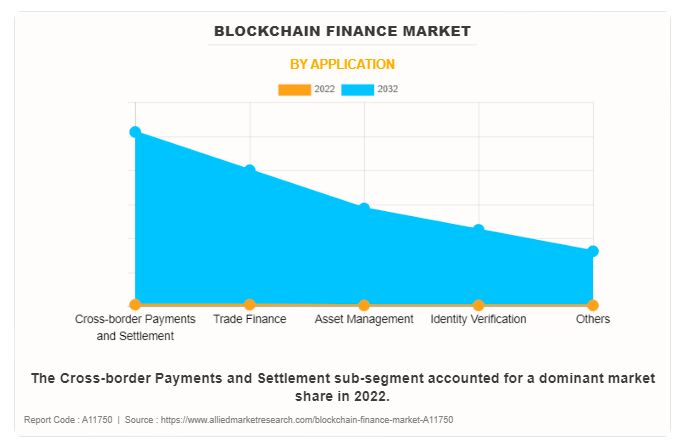

In the realm of blockchain finance applications, cross-border payments and trading stand out as two significant sub-sectors. These segments are experiencing substantial growth due to increasing demand from individuals, businesses, merchants, industries, and international development organizations.

The cross-border payments and settlement sub-category hold a commanding market share. This information is drawn from Allied Market Research.

As depicted, this trend is anticipated to persist, driven by users’ ongoing quest for more cost-effective methods to transfer their funds globally. In 2022, North America took the lead in the blockchain finance market and is projected to retain its position as the leader in blockchain finance adoption.

Key Points from the Blockchain Finance Market Report. Source: Allied Market Research

After conducting a quantitative analysis of trends and dynamics within the blockchain finance sector, Allied Market Research forecasts a remarkable compound annual growth rate (CAGR) of 60.5%. According to these projections, the industry is on track to evolve into a market worth $79.3 billion.

A recently released report from the digital payments network Ripple suggests that blockchain technology has the potential to save financial institutions around $10 billion in cross-border payment expenses by the year 2030.

“In the survey, more than half of the respondents expressed the view that the foremost advantage of cryptocurrency lies in reducing payment expenses, both within their own country and for international transactions,” the report highlights. This statement aligns with the findings of Allied Market Research’s report, which derives its growth projection from the availability of more economical and secure alternatives.