Bitcoin (BTC) Rebounds After ‘Black Swan’ Event Resembling March 2020 COVID-19 Crash, Indicating Recovery

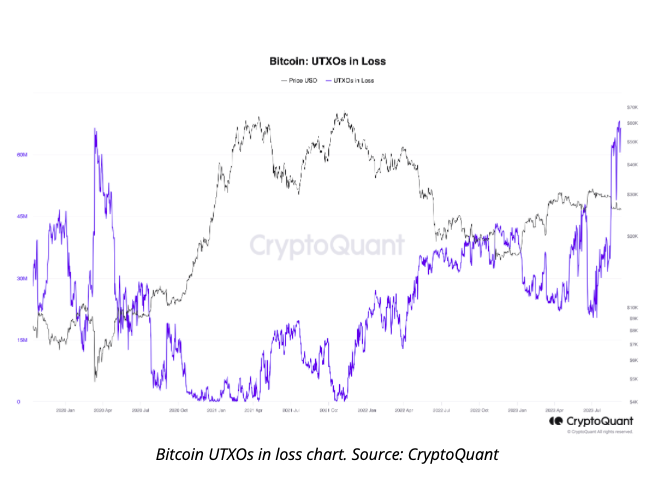

On September 7, CryptoQuant, an on-chain analytics platform, highlighted a significant surge in unprofitable unspent transaction outputs (UTXOs), underscoring Bitcoin’s resurgence from an event comparable to the March 2020 COVID-19 crash. Bitcoin is currently valued at $25,770.

CryptoQuant: Loss-Making Bitcoin UTXOs Reflecting March 2020 Situation

While Bitcoin’s recent price weakness may be causing concern among market participants, on-chain data reveals an intriguing perspective on the underlying activity.

UTXOs, representing the remaining BTC after an on-chain transaction, are under scrutiny through CryptoQuant’s UTXOs in Loss metric. This metric tracks instances where a significant number of UTXOs are now valued lower than their initial purchase price.

At present, there is a higher number of UTXOs in a loss position compared to any time since March 2020. During that period, BTC/USD plummeted by 60%, reaching its lowest levels since March 2019, levels that were not revisited thereafter.

Drawing parallels with the current UTXOs in Loss data, CryptoQuant contributor Woominkyu suggests that Bitcoin might be experiencing or recovering from a sudden and unexpected selling event, similar to what occurred in March 2020.

In summary:

In August’s closing, 38% of UTXOs were at a loss, a percentage that had not been observed since April 2020.

Woominkyu elaborated, “A high number of UTXOs in a loss position may indicate market anxiety, potentially prompting investors to consider selling. Conversely, when the majority of UTXOs are in profit, it signifies optimism and a prevailing sentiment of holding among investors.”

The number of Bitcoin speculators in a loss increases.

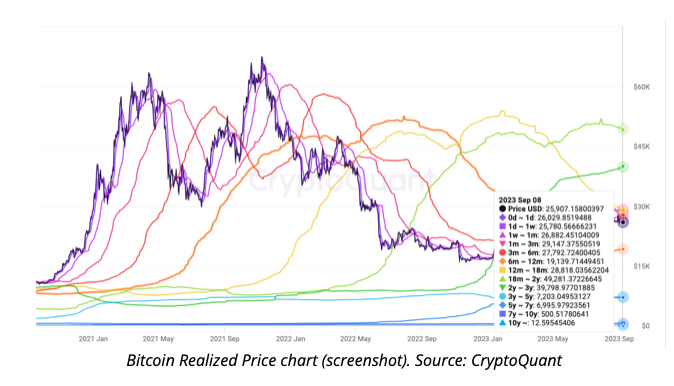

Bitcoin, on the other hand, continues to be trapped within a narrow range due to the absence of a clear overall price trend. The data on acquisition costs also reflects the current spot price being sandwiched between the purchase prices of different investor groups.

This is evident in the “Realized Price,” which calculates the price at which the supply was last moved, divided by age group. It indicates that short-term holders experience a collective loss when BTC/USD falls below approximately $27,000.

Nevertheless, it’s worth noting that a complete capitulation event has not been observed on-chain yet.