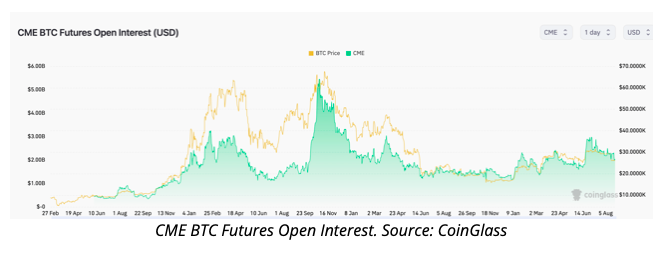

JPMorgan’s recent research suggests that the cryptocurrency market’s downward trend is approaching its conclusion, with most long-position liquidations believed to have concluded. As per a Bloomberg report, analysts at the American bank predict that the phase of liquidations is mostly in the past. This assessment is drawn from the data on open interest in Bitcoin (BTC) futures contracts on the Chicago Mercantile Exchange (CME), which hints at a potential slowdown in the selling trend. Open interest, representing active futures contracts, serves as an indicator for market sentiment and the robustness of price movements.

Analysts interpret the decrease in Bitcoin’s open interest as an indication of a potential weakening in the ongoing price trend. Consequently, they anticipate that there is limited downside for the cryptocurrency markets in the near future.

According to the report, recent weeks have witnessed a decline in cryptocurrency prices due to diminishing optimism surrounding regulatory advancements in the United States. As of August 26th, Bitcoin is trading around $26,000, indicating an 11.27% drop over the last 30 days, as reported by Cointelegraph Markets.

The preceding months observed positive progressions that bolstered Bitcoin’s value. Notably, numerous applications were submitted for the first-ever U.S. exchange-traded funds (ETFs) linked to Bitcoin’s spot price. This list of contenders awaiting regulatory clearance includes prominent names such as BlackRock, Fidelity, ARK Investments, 21Shares, and various other asset management firms.

Another positive development was Ripple Labs’ partial victory against the United States Securities and Exchange Commission (SEC). However, the analysis highlights that this optimism is gradually waning, as traders await decisions on Bitcoin ETFs and the SEC’s appeal against Ripple introduces renewed uncertainty.

This scenario, as noted by JPMorgan’s team, contributes to a “fresh cycle of legal uncertainty” for the cryptocurrency markets, rendering them susceptible to forthcoming developments. External market conditions have also played a part in the cryptocurrency market’s downturn, including the ascent of U.S. real yields and concerns regarding China’s economic growth.