Bitcoin’s closure below $29,000 on August 16 marked the first occurrence in 56 days. Analysts swiftly attributed this occurrence to the recently released Federal Open Market Committee minutes, which highlighted worries about inflation and the necessity of raising interest rates.

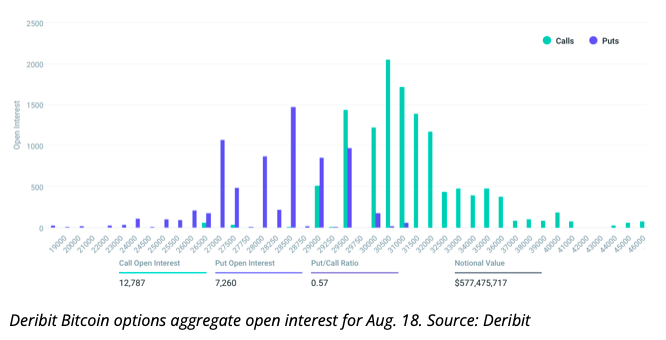

Although the immediate catalysts for the decline are clear, the impending expiration of $580 million worth of Bitcoin options on Friday, with a strike price of $26,482, seems to favor the bearish sentiment. This potential scenario could result in a $140 million profit on August 18, further contributing to the downward momentum of Bitcoin. This complicates the cryptocurrency’s pursuit of a stable price floor.

Federal Reserve Minutes Have No Effect on Conventional Markets

Federal Reserve’s Emphasis on 2% Inflation Target Triggers Shift in Market Preferences

On August 16, Federal Reserve Chair Jerome Powell reiterated the significance of the 2% inflation target. This statement propelled the U.S. 10-year Treasury yield to its highest point since October 2007, prompting investors to pivot away from riskier assets such as cryptocurrencies. Instead, they favored cash positions and companies that have solid preparation for such economic scenarios.

Significantly, Bitcoin had already experienced a drop to $29,000, its lowest level in nine days, before the Federal Reserve minutes were released. The impact of these minutes remained restricted, particularly as the rising 10-year yield indicated doubts about the Federal Reserve’s capacity to manage inflation effectively.

Furthermore, on August 17, S&P 500 index futures only exhibited a 0.6% decrease compared to their pre-event level on August 16. Concurrently, WTI crude oil observed a 1.7% increase, while gold saw a 0.3% decline.

Concerns about China’s economic situation might have also played a role in the market decline. The country reported lower-than-anticipated growth in retail sales and fixed asset investment, which could potentially influence the demand for cryptocurrencies.

While the precise causes behind the price drop remain uncertain, there is a chance that Bitcoin’s trajectory could reverse after the weekly options expiry on August 18.

Bitcoin bulls cast the wrong bet

During the span of August 8 to August 9, the Bitcoin price briefly surpassed the $29,700 threshold, evoking a sense of positivity among traders engaged in options contracts.

The 0.57 put-to-call ratio signifies the contrast in open interest between call (buy) options valued at $365 million and put (sell) options valued at $205 million. However, the final outcome will fall below the total open interest of $570 million, as the recent unexpected drop in Bitcoin’s price below $29,000 caught bullish investors off guard.

For instance, if Bitcoin’s price hovers around $28,400 at 8:00 am UTC on August 18, only $3 million worth of call options will hold value. This distinction arises because the right to acquire Bitcoin at $27,000 or $28,000 becomes void if BTC trades below these levels at expiration.

Outlined below are the three likeliest scenarios based on the present price movement. The count of available options contracts on August 18 for both call (buy) and put (sell) instruments fluctuates based on the expiration price. The asymmetry favoring either side contributes to the theoretical profit:

- Between $26,000 and $28,000: 100 calls vs. 5,300 puts. The outcome leans in favor of put (sell) instruments by $140 million.

- Between $28,000 and $28,500: 100 calls vs. 3,900 puts. The outcome leans in favor of put (sell) instruments by $60 million.

- Between $28,500 and $29,500: 600 calls vs. 1,300 puts. The outcome leans in favor of put (sell) instruments by $20 million.

With mounting investor apprehensions about an impending economic deceleration due to central banks’ efforts to manage inflation, it’s probable that Bitcoin bears will retain their advantage. This trend extends beyond the upcoming Friday expiry and is anticipated to persist, particularly as the likelihood of BTC bulls achieving their primary short-term objective – the approval of a spot exchange-traded fund – remains slim.

As a result, those with a bullish stance find themselves in a challenging position. The viability of their call (buy) options hinges on Bitcoin’s expiration price surpassing $28,500. The most plausible scenario, favoring bears with a potential gain of $140 million, suggests the potential for further correction in Bitcoin’s price.