A recent analysis from research firm Delphi Digital highlights the consistent and foreseeable nature of price movements and patterns in the cryptocurrency market. The report thoroughly explores the correlation between the four-year Bitcoin cycle and larger economic trends.

Delphi Digital’s experts suggest that the current consolidation around the $30,000 mark resembles the phase observed between 2015 and 2017. Key indicators are pointing towards a potential Bitcoin all-time high (ATH) occurring in the fourth quarter of 2024.

Influence of Economic Cycles on Bitcoin’s Performance

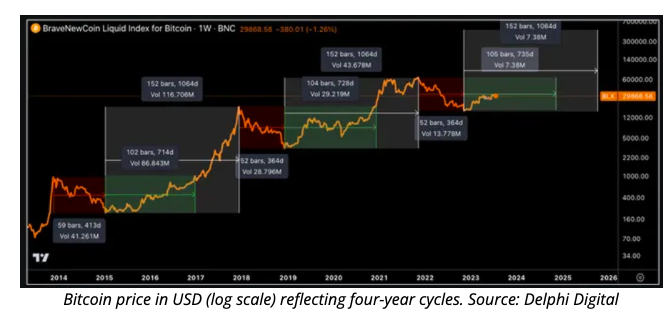

Delphi’s examination highlights the innate cyclical patterns present in the cryptocurrency market. These cycles are exemplified by the intervals between low points, the time taken to rebound to past cycle peaks, and the timing of price surges to reach new cycle peaks. Employing Bitcoin as a reference point, Delphi delineates the fundamental framework of a cryptocurrency market cycle.

These cycles spanning four years encompass Bitcoin achieving a fresh all-time high (ATH), undergoing an approximately 80% decline, followed by a bottoming out around a year later. This is often succeeded by a two-year recuperation to reach previous peaks and, ultimately, a one-year surge in prices culminating in a new all-time high.

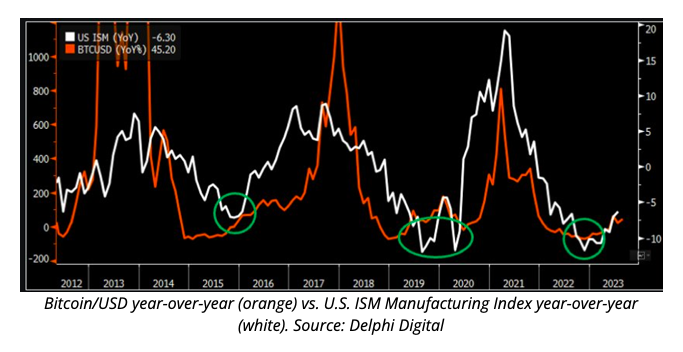

The study unveils an intriguing connection between Bitcoin’s price peaks and shifts in the business cycle, as reflected by the ISM Manufacturing Index.

When Bitcoin reaches its price zeniths, the ISM commonly displays indications of reaching its peak, accompanied by active addresses, transaction volumes, and fees hitting their zenith as well. Conversely, as the business cycle hints at recuperation, network activity levels also show a corresponding increase.

The study underscores the significance of Bitcoin halvings in these cycles. The preceding two halvings took place roughly 18 months after BTC hit its bottom and approximately seven months prior to a fresh ATH. This historical trend implies a potential new ATH for Bitcoin around the fourth quarter of 2024, aligning with the anticipated timing of the upcoming halving.

The movement of Bitcoin’s price appears to bear resemblance to the pre-bull run phase observed between 2015 and 2017.

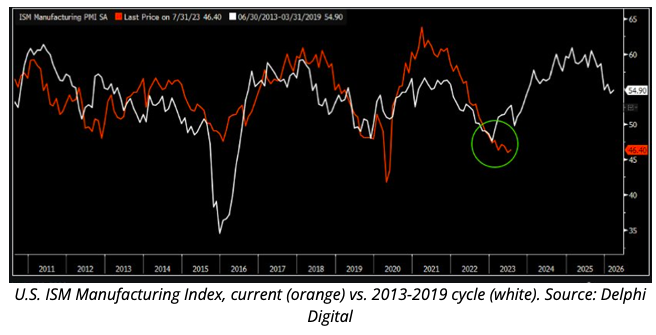

The report also proposes that the present market landscape bears remarkable resemblances to the era spanning 2015 to 2017. The congruence of market behavior, economic indicators, and historical trends implies that the ongoing phase shares similarities with a period of heightened risk exposure and potential growth, reminiscent of that earlier timeframe.

The report underscores that the trading patterns in the market, particularly evident in the S&P 500, closely mirror the trajectory witnessed between 2015 and 2017. These patterns endure even in times of uncertainty, such as during an earnings recession, reflecting the sentiment prevalent during that specific period.

The persistent cycle pattern of Bitcoin, its synchronization with broader shifts in the economy, and the impending halving in 2024 collectively contribute to support this thesis.

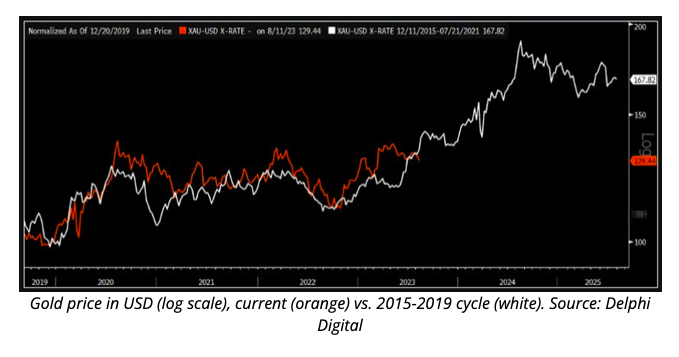

Delphi emphasizes the striking similarities between the pessimistic global growth perspective of 2015-2016 and the recent phase of economic instability in 2021-2022. Elements such as the potency of the U.S. dollar and fluctuations in worldwide liquidity patterns resonate with historical trends.

The report highlights how gold’s performance during that era, shaped by apprehensions about currency devaluation, showcases noteworthy resemblances to the current scenario. These correlations strengthen the assertion that macroeconomic circumstances are unfolding along a familiar path.

Cryptocurrency Market Exhibits Positive Sentiment Amidst Warning Signs

Delphi’s Analysis Highlights Crypto Market’s Cyclical Nature in Line with Broader Economic Trends

Delphi’s comprehensive analysis presents compelling evidence that the cryptocurrency market operates within cyclic patterns that echo broader economic shifts. The report’s projection of a forthcoming all-time high by the fourth quarter of 2024 aligns harmoniously with historical halving trends. This synchronization of timing, coupled with the condition of indicators like the ISM and expectations of renewed liquidity cycles, bolsters the case for a cycle reminiscent of the one witnessed between 2015 and 2017.

The upcoming Bitcoin halving in 2024 further lends credibility to the firm’s anticipation of a potential bull market by the fourth quarter of that same year. While the analysis acknowledges potential risks and uncertainties, the overall outlook for the cryptocurrency market in the next 12-18 months holds promise, buoyed by accumulating catalysts and historical precedence.