Bitcoin (BTC) continued to decline in value, reaching $29,436 on August 12th, while maintaining its remarkable price behavior marked by substantial volatility.

Anticipating a “Classic weekend chop” for Bitcoin

Information sourced from Cointelegraph Markets Pro and TradingView depicted a relatively stagnant Bitcoin trading atmosphere at the commencement of the weekend.

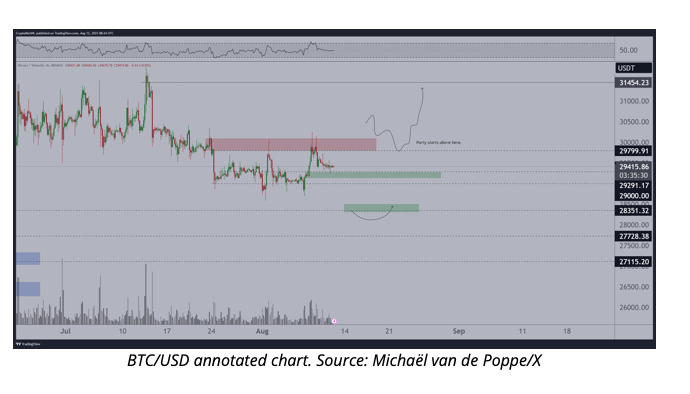

Despite the subdued responses to the macroeconomic data releases from the United States throughout the week, the BTC/USD pair maintained its position close to $29,500, a significant zone of contention between bullish and bearish forces.

In a recent analysis, well-known trader Daan Crypto Trades indicated, “Foreseeing a typical weekend scenario of price fluctuations around the CME closing value,” alluding to the concluding figure of CME Bitcoin futures markets at $29,465.

Data derived from Cointelegraph Markets Pro and TradingView illustrated a relatively uneventful Bitcoin trading environment as the weekend kicked off.

Despite the lackluster reactions to the macroeconomic data releases from the United States over the course of the week, the BTC/USD pairing maintained its position near the $29,500 mark, which served as a notable battleground between bullish and bearish sentiments.

In a recent analysis, the renowned trader Daan Crypto Trades conveyed, “Envisaging a standard weekend scenario of price fluctuations around the closing value of CME Bitcoin futures,” referencing the concluding price point of $29,465 for CME Bitcoin futures markets.

Conducting an examination of exchanges, Maartunn, a contributor to the on-chain analytics platform CryptoQuant, observed an emergence of long positions originating from Bitcoin whales.

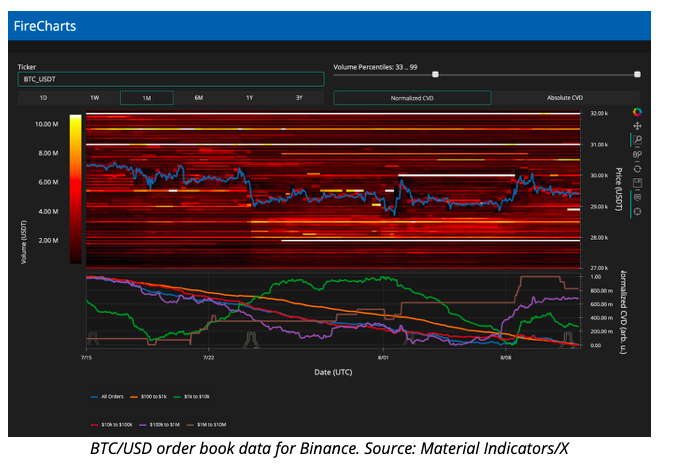

When observing the resource Material Indicators for monitoring purposes, the order book of Binance BTC/USD indicated that the state of rangebound conditions would probably continue.

Accompanying commentary mentioned, “Volatility could begin to increase as we approach the weekly Close/Open. The prevailing sentiment remains akin to buying the dip and selling the rally conditions.”

BTC price approaches “historic compression”

Examining the absence of volatility in the Bitcoin market, traders within the community speculated that a comparably strong return to the established trend should ensue.

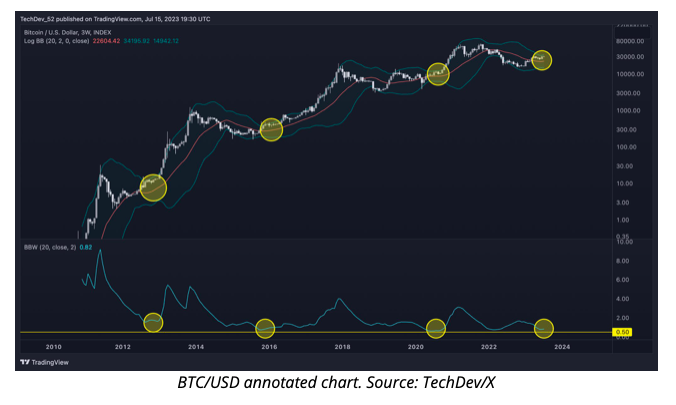

“Bitcoin is nearing unprecedented 3-week compression levels above the 20 MA. The countdown begins,” forecasted well-known trader TechDev, making reference to the 20-period moving average on three-week timeframes.

An associated chart depicted the price movement of BTC following analogous occurrences in the past, which have occurred only four times since the inception of Bitcoin.

In response, fellow trader Credible Crypto commented, “Remarkable compression often paves the way for notable expansion… envision examining this chart and considering the possibility of a $10k trend.”