According to market cyclist Cole Garner, Bitcoin (BTC) is currently experiencing a downtrend with its ticker down to $29,037. However, he believes that this is just a classic setup for a “full bull” phase in the BTC price. Garner’s social media analysis on August 6 suggests that significant upside potential awaits not only Bitcoin but also the broader cryptocurrency market.

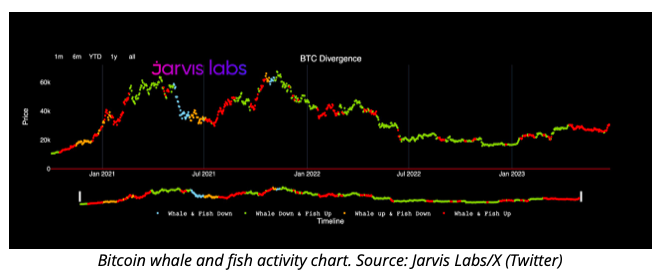

In addition to whales, smaller investors, referred to as fish, have also been increasing their exposure to BTC. According to popular technical analyst CryptoCon, whales are being dubbed “diamond hands” due to their resilient behavior in the current cycle.

A segment of the analysis from August 3 reveals that the small investor to whale ratio is experiencing a significant surge. This indicates that during the current cycle (2022 – 2023), the investors who have been selling are primarily small investors, while the whales are holding onto their positions steadfastly.

According to CryptoCon, in Bitcoin’s previous cycle, there was a constant and unyielding selling pressure from whales. However, this time around, such relentless whale selling is notably absent.

He further emphasized that during the last bear market, it was the retail investors who sold off their holdings, while the whales remained resolute and didn’t show any signs of wavering.

The entire situation depends on the 200-week moving average of BTC price.

Garner emphasized the importance of the Bitcoin-to-stablecoin ratio on Bitfinex, a major exchange. This ratio has historically preceded significant bull runs in Bitcoin’s history, as previously reported by Cointelegraph.

According to Garner, the Bitfinex Whale holds significant influence in the short-to-medium term price movements of BTC, surpassing other entities in the crypto space in terms of impact.

However, the exact timing of a bullish BTC price breakout remains uncertain, and Garner leans towards a potential launch in the third quarter (Q3).

Garner acknowledged that one of the strongest counter-arguments against a bullish scenario is the influence of summer seasonality, which might exert a more powerful force than many people realize.

To invalidate the bullish outlook, Garner concluded that Bitcoin would need to experience a weekly close below its 200-week simple moving average (SMA), which currently stands at $27,235, based on data from Cointelegraph Markets Pro and TradingView.