Achieving true decentralization is a goal pursued by many crypto projects. However, the outcomes often prove too intricate for regular users to embrace confidently. So, what could be the remedy?

Recent incidents, including the notable downfall of major industry players like the cryptocurrency exchange FTX, have laid bare the excessive centralization prevailing in the crypto realm. Former FTX CEO, Sam Bankman-Fried, is currently facing a series of criminal charges, with allegations suggesting that his decision-making significantly contributed to the exchange’s collapse.

Challenges of true decentralization

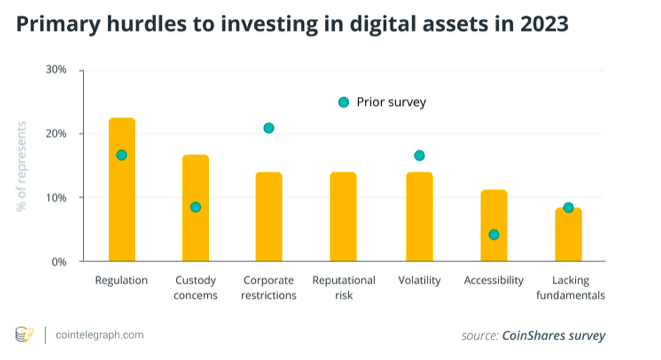

Despite the importance of true decentralization in unleashing the potential of the emerging crypto market, certain protocols that meet this criterion are overly complex for practical use. Unfriendly interfaces and convoluted processes increase the likelihood of customers making costly errors or even facing complete loss of their funds. It is no surprise that a recent survey by CoinShares, which gathered responses from 51 asset managers managing $900 billion worth of funds, highlighted custody as one of the major obstacles when incorporating cryptocurrencies into portfolios.

There are also practical considerations to take into account. In the traditional fiat world, consumers typically have a single bank account—a centralized hub where funds are managed. However, in the decentralized and diverse crypto ecosystem, with numerous platforms and thousands of altcoins, investors may lose track of their numerous logins. This complexity adds friction and hampers the process of efficiently managing one’s finances.

In contrast, super apps have gained popularity in China, such as WeChat, which offers users a wide range of functionalities in one convenient place, from payments to gaming, and hosts millions of third-party applications. Inspired by this success, Elon Musk aims to transform Twitter into an “everything app.”

These developments prompt a significant question: Why aren’t more decentralized platforms providing a comprehensive all-in-one experience? This is precisely the market gap that YieldFlow is striving to address.

The Comprehensive All-in-One Solution for Investors

YieldFlow: Bridging True Decentralization with User-Friendly Simplicity

YieldFlow’s primary objective is to seamlessly integrate genuine decentralization with a straightforward and user-friendly interface. The platform operates solely on smart contracts, which are publicly listed and audited by CertiK, ensuring complete transparency and enabling anyone to verify and scrutinize them. Moreover, YieldFlow does not collect personal data, eliminating the need for Know Your Customer (KYC) checks to connect a wallet. By removing fiat gateways, the platform delivers a crypto-only experience.

As its name suggests, YieldFlow aims to democratize yield farming, making it accessible to a wider audience while mitigating the risks associated with centralized providers. Simultaneously, it supports those with limited technical knowledge, making the process more inclusive and user-friendly.

YieldFlow’s core principle revolves around automating intricate processes that crypto enthusiasts often need to handle manually, freeing users to concentrate on their core priorities.

With an ambitious vision for the future, YieldFlow has set up a roadmap that allows users to participate in voting for upcoming proposals. Next year, the platform will integrate staking and lending products into its comprehensive offering, including digital real estate and art. As it looks ahead to 2025, YieldFlow is planning to introduce fully-backed digital assets tied to commodities and stocks.

Embracing the philosophy that bear markets present opportunities for growth, YieldFlow is steadfast in its commitment to delivering a platform that offers a sense of certainty and stability for crypto enthusiasts, particularly during uncertain times.